Johnson and Johnson has paid $BILLIONS in criminal settlements

… and never produced a vaccine before – why would we trust them for a new experimental COVID vaccine?

Progressive Radio Network, March 5, 2021

For decades, according to a Guardian article,

“consumers worldwide have named the $347 billion pharmaceutical behemoth Johnson and Johnson (J&J) as one of its most trusted brands.”

From its humble beginnings in the 1880s, making cotton gauze dressings and eventually band aids, baby powder and shampoo, J&J has expanded into one of the most powerful multinational pharmaceutical and medical device companies in the world.

In 1959, it entered the world of Big Pharma as a leading player after succeeding in getting Tylenol approved as an over-the-counter drug.

Shortly thereafter J&J commenced with a flurry of acquisitions to increase its product line, which included Neutrogena, Cordis, DePuy, Janssen Pharmaceutica and Centocor.

Today, in most American home medicine cabinets one will find a popular J&J product: Listerine, Tylenol and Benadryl, Neutrogena skin cream, Rogaine, Neosporin antibacterial ointment, or Desitin to treat diaper rashes.

Now, people are eager for J&J’s “one shot and you’re done” Covid-19 vaccine despite health officials’ fears it may be less effective than Moderna’s and Pfizer’s mRNA competitors.

Nevertheless, vaccination centers and pharmacies are racing to get their hands on the new adenovirus-based vaccine. And as we will further note below, this is from a company that has absolutely no past experience in vaccine development and manufacturing.

We need to seriously challenge J&J’s reputation

However, we need to seriously challenge J&J’s reputation.

A 2019 report by the British intelligence firm Alva has noted that J&J’s reputation has sunk dramatically during the past years, from 9th place among 58 major pharmaceutical firms to 57th.

Certainly, this is not a company with a clean ethical record.

A review of J&J’s rap sheet over the past three decades presents a dire and contrary image that should lead us to question the company’s claims about its Covid-19 vaccine given the lucrative market the pandemic has created for the most aggressive medical corporations.

J&J has had to pay out billions of dollars over the decades for civil settlements and criminal activities

Similar to its equally over-sized competitors Glaxo, Merck and Pfizer, J&J too has had to pay out billions of dollars over the decades for civil settlements and criminal activities.

As the pharmaceutical giant receives applause across the mainstream media for the release and FDA emergency approval for its Covid-19 vaccine, Brazil’s Public Prosecution Service started an investigation into J&J’s antitrust activities under the Foreign Corrupt Practices Act (FCPA) for “possible improper payments in its medical device industry.”

This was part of an FBI bribery scheme investigation that included Seimens, General Electric and Philips acting as a larger cartel to illegally payoff government officials in return for securing contracts with Brazil’s national health programs.

The charges also include price gouging, inflating prices up to 800 percent the market price to cover bribes.

This is not the first time J&J has violated FCPA laws.

In 2011, J&J was charged by the Department of Justice with conspiracy for paying off Greek doctors to advance its product sales. The SEC also charged civil complaints.

The company had to pay out a $70 million penalty for buying off officials in Greece, Poland and Romania.

In 2010, an executive for J&J’s subsidiary DePuy was sentenced to a year in prison for corrupt payments to physicians within the Greek national healthcare system.

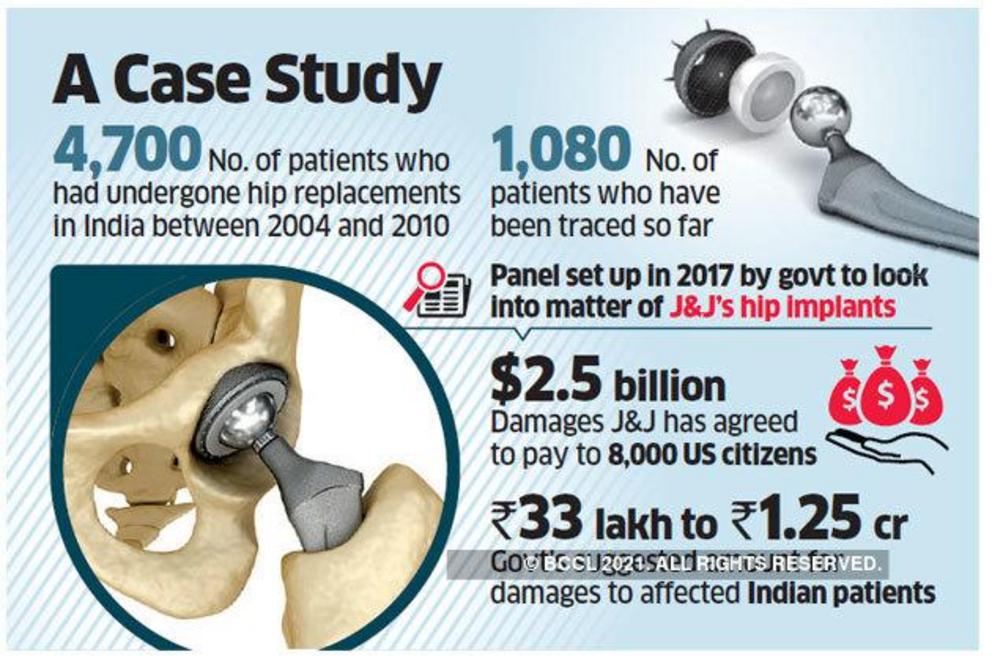

As one of the world’s leading medical device companies, J&J has had its share of recalls for faulty products including contact lenses and hip implants.

In 2013, it paid nearly $2.5 billion to compensate 8,000 recipients for its flawed hip implants. Again in 2016, another $1 billion was awarded to plaintiffs injured from this device.

One particular dubious activity the company became involved with in 2008 was to launch a “phantom recall.”

When its Motrin IB caplets were discovered to not properly dissolve, it hired outside contractors to buy up store supplies in order to avoid making public declaration.

No one would have known of this activity and it would have gotten past the eyes of FDA inspectors had the deception not been exposed during a Congressional investigation.

Other major J&J lawsuits and recalls for faulty products include:

1995 – $7.5 million fine for destroying documents to cover up an investigation into wrongful marketing of its Retin-A acne cream to remove wrinkles

1996 – An undisclosed settlement on false claims over condom protection claims to protect against HIV and other STDs.

2000 – J&J’s subsidiary LifeScan was found guilty for selling defective blood glucose monitors and failed to inform the FDA. All total, $105 million was paid out.

2001 – Paid out $860 million in a class action lawsuit for misleading customers about prematurely discarding its 1-Day Acuvue soft contact lens.

J&J recommended they should only be worn once although it was discovered the lenses were no different than the regular Acuvue lens that would last for two weeks

2010 – $81 million settlement for misbranding its anti-epileptic drug Topamax to treat psychiatric disorders and hiring outside physicians to join its sales force to promote the drug for unapproved conditions.

The following year, J&J paid $85 million for similar charges against its heart drug Natrecor

2011 – Several of its baby products were discovered to contain carcinogenic ingredients.

2013 – The US Justice Department charged the company $2.2 billion in criminal fines for marking its autism and anti-psychotic drug Risperdal for unapproved uses. Forty-five states had filed civil lawsuits against J&J in the scandal.

Risperdal is a horrendous drug that contributes to rapid weight gain and a condition known as gynescomastia, irregular enlarged breasts in men.

Semmelweis reports that J&J’s subsidiary Janssen also had an aggressive campaign to market its use in children with behavioral challenges.

Other serious adverse effects from Risperdal reported by the FDA include diabetes mellitus, hyperprolactinaemia, somnolence, depression, anxiety, psychotic behavior, suicide and death.

The company’s legal problems over Risperdal do not appear to have ended.

In October 2019, a Philadelphia jury awarded a man $8 billion in punitive damages for failing to warn that the drug could cause young men to grow breasts. Other recent suits include litigation over its blood thinner Xarelto risks of internal bleeding, and a $775 million settlement to 25,000 plaintiffs.

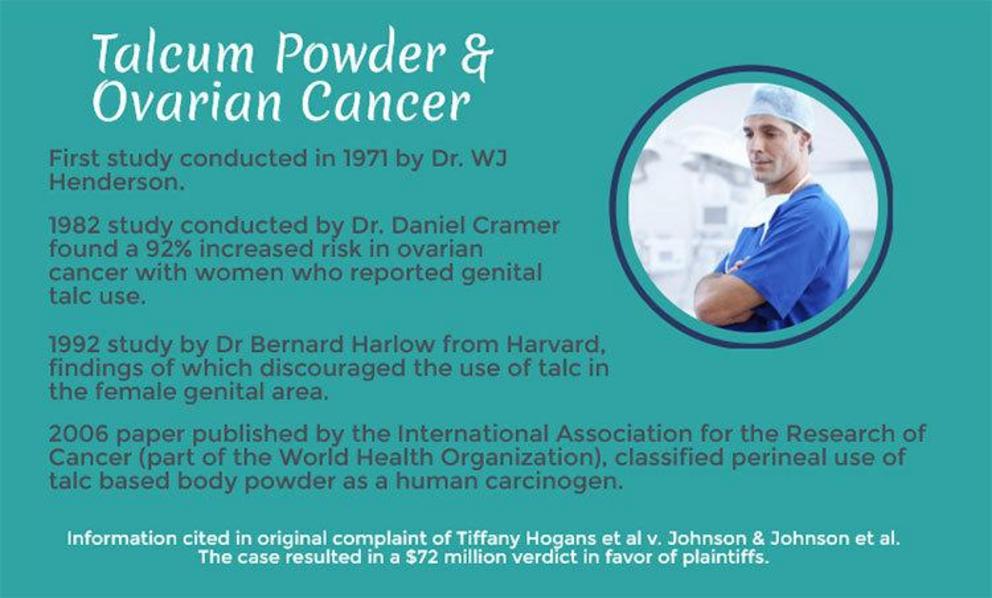

2016 – Two women were awarded $127 million in damages for the talc in its J&J Baby Powder causing ovarian cancer. Later, over 1,000 similar cases came forward.

During the trial it was discovered that J&J suspected a link between talcum and ovarian cancer back in the 1970s. A Missouri verdict fined the company over $4 billion but it was later reduced to $2.1 billion.

A New York Times investigation into internal J&J memos uncovered evidence that the talcum powder may have contained asbestos. These cases continue. In July 2019, J&J made efforts to dismiss 14,000 lawsuits over the talcum-cancer risk.

More recently, J&J has been in the spotlight for its role in contributing to the deadly opioid crisis.

The company holds the patent for a unique strain of opium poppy commonly named Norman. It is the leading provider of the opioid for Purdue Pharma’s painkiller OxyContin.

An Oklahoma court ordered a $465 million fine. This opened the door for other states to follow suit.

To fully realize how insane the system is, the half a billion dollar civil fine was good news on Wall Street, which anticipated the verdict would be in the billions of dollars.

Consequently, J&J’s stock rose 2 percent after the judge’s ruling.

And despite J&J being Purdue’s major supplier, and a major contributor in the US’s opioid epidemic, the latter was forced to file for bankruptcy due to mounting lawsuits for overdose deaths.

Why is a 140 year old company, with no history whatsoever in vaccine development, now a Covid-19 vaccine producer?

Finally, we might ask why a 140 year old company, with no history whatsoever in vaccine development, has now become among the heroes in the immunological war against Covid-19?

J&J is not a household name in the vaccine industry. It is utterly absent, let alone ranks among the world’s 20 major vaccine makers.

Among the 53 vaccines for other infections approved and licensed by the CDC, not one is manufactured by the nation’s leader in mouthwash and baby powder.

It is therefore no surprise that the company had to partner with Merck to manufacture its Covid vaccine to meet demand. It has no history or expertise in this medical field.

However, the Covid pandemic is a cash cow for the drug industry’s taking.

Bernstein market analyst Ronny Gal predicts Covid-19 vaccine sales will reach $40 billion this year. A more realistic figure is likely higher since together Moderna and Pfizer project their revenues at $32 billion.

Then there are the other major vaccines by AstraZeneca, J&J and Novavax entering the competition. According to the London School of Hygiene and Tropical Medicine’s vaccine research tracker, over 200 vaccines against Covid-19 are in development worldwide.

It is an enormous pumpkin pie and everyone in the medical universe wants a slice from it. So why shouldn’t we expect a non-vaccine player such as J&J to be eager to leap into the frenzy?

Finally, there is a disturbing question that we have no certain answer for. How is it that a drug and household health product company, with no prior history in vaccine development, can develop and rush to market its first vaccine against a viral strain that was only identified 14 months ago?

Developing a vaccine requires many years and necessitates the establishment of an R&D infrastructure vastly different than conventional drug development.

The other major companies developing Covid-19 vaccines have been in the business for decades. But not J&J.

There is something more to this story that demands investigation. And if the company’s long rap sheet offers any warning, it is that we must be wary of any claims J&J publicly states about the efficacy and safety of its products. Especially when the pandemic promises to increase the profits of numerous shareholders.