Fake News?

TAKE ACTION: Financial Takeover & Your Bank Account – BlackRock, Envestnet/Yodlee, and The Federal Reserve

Ever hear of Yodlee? Neither had I, until I discovered it was aggregating my data in my bank account, and likely selling it to third parties. This quickly became a personal dig, until I found staggering connections that I realized the public needs to be made aware of. Before you determine this has nothing to do with you, I urge you to review this article in its entirety and pay close attention to the timeline actions, because this affects ALL OF YOU, and it’s being rolled out in multiple countries. Then, I encourage you to check with your bank and find out exactly which third parties are wrapped up in your accounts, and consider the option of moving your funds to a smaller local bank. This isn’t just about spying and data aggregating, this is a structural setup to move us into the social/climate score system and beyond, and Biden is penning the orders to build the framework that BlackRock has devised.

Investigate Your Bank, Financial Institutions, and Your Accounts

Short Summary

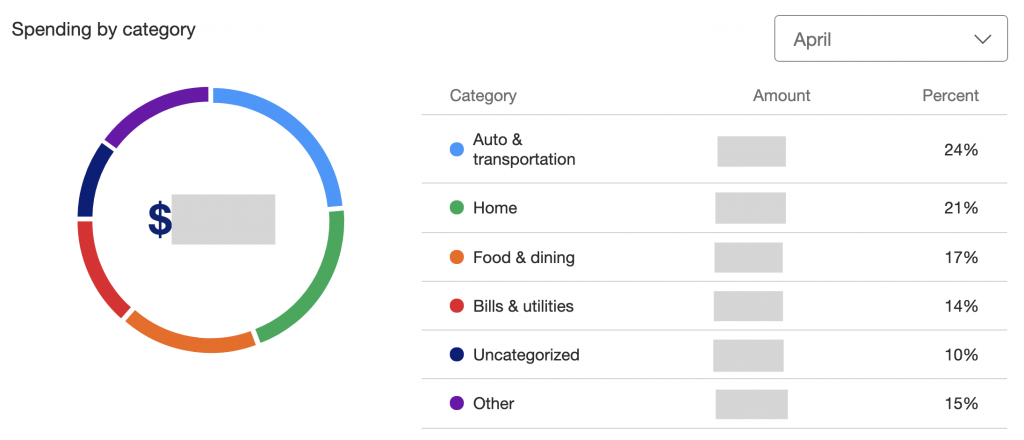

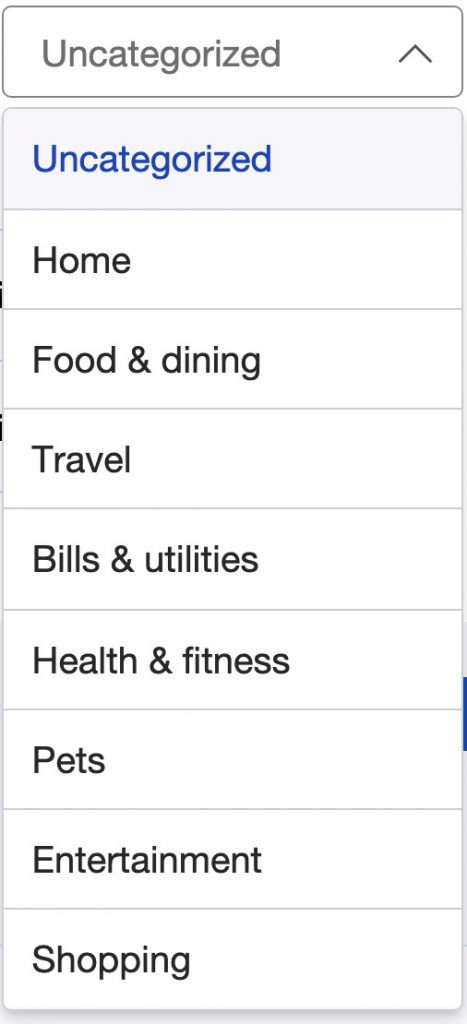

To quickly summarize, I had noticed that my bank account was suddenly categorizing my expenses into groups such as; income, health & fitness, food & dining, travel, business services, pet supplies, and so on. Immediately, I could see where this was going, and was particularly annoyed by the “income” category where they were mislabeling funds under that category, which puppet Biden is pushing to be forwarded directly to the IRS. To build a social score system for how and where you will be able to spend your funds or get access to locations or services, and for big gov to spy on every penny spent, a structure must first be built. I quickly looked for the 3rd party disclaimer to see who was organizing my personal financial data, and found “account aggregation services are provided by Yodlee, our third-party vendor. Data is obtained by Yodlee or manually entered.” I then went to the section that allegedly allows you to limit data that is shared, only limiting Yodlee wasn’t an option. I called my bank and asked when the contract began and I was told in 2017. I asked what else Yodlee was involved with in my bank account, aside from this new category aggregation, and was informed that they couldn’t find anything. I asked if they were selling my data, and the man didn’t know. I requested it be removed and was told they cannot do that. I stated I was going to close my accounts if they cannot do this and wished to speak with a manager. I was told I would receive a call. I never did, and you can bet your bottom dollar, I moved my funds.

As you will see in the timeline below, Yodlee is one of the largest financial aggregators, who also happens to sell your data and has a class action lawsuit against them, but that won’t stop this train. They were acquired by Envestnet back in 2015. To put this in perspective, Envestnet works with 17 of the top 20 banks along with 5,200 other banks, financial institutions, and companies. They serve $4.8 trillion in assets, manage $229 billion in assets, and power more than 2 million financial plans a quarter. Envestnet services 500 million aggregated accounts each day.

Three years later, in 2018, BlackRock, the world’s largest investment manager, bought an equity stake in Envestnet and partnered with them to integrate their technology with Envestnet’s. The following year, Envestnet’s CEO and his wife, died in a fatal car crash, just after the “Going Direct” reset was signed into place. Just a few months later, three democrats filed for an FTC investigation into Envestnet/Yodlee over privacy concerns for consumers (that’s comical), which essentially strong-armed Envestnet. This is only the tip of the iceberg, but paints a bit of a picture when digesting the timeline below. This timeline could have been well over 30-pages expanding on BlackRock’s involvement since they are running the NWO financial show, but this is meant to bring awareness to people so they can investigate their own banks and make decisions for themselves about who they wish to bank with and how they wish to protect their financial data and finances.

BlackRock has positioned itself in three high-ranking positions at the White House, manages $7.8 trillion in other people’s assets making it the largest money manager in the world, is in the top three shareholder positions in every major company and industry (just check for yourself), invests heavily in “climate change” and shuns fossil fuels, and has gobbled up much of its competition. Rulers BlackRock and Vanguard, are expected to be managing $20 trillion by 2027. It’s no surprise that BlackRock and the White House have a revolving door through the Clinton, Obama, and Biden administrations. In addition to staff shifting between the them, board members of BlackRock, such as Cheryl Mills, who served for both Clintons during their time at the White House, also seem to drift over to BlackRock. They are the designer of the Going Direct Reset and are helping to lead the way.

Under the guise of “financial wellness” and “climate-related financial risk,” they have shifted the financial industry to streamline and surveil everyone’s financial data so that they can control it through a social score system, tell you how and where to spend your money, and siphon what they deem should go to the IRS. Additionally, there are trillions of dollars about to switch hands from the elderly to the Millennials, and these folks have their teeth in all of it. Review the complete timeline to understand how all of these actions impact everyone.

As I noted last year when stimulus checks rolled out in direct deposit, that was done to establish a more comprehensive database than they already had compiled on US citizens bank accounts. It was just one more stepping stone in their grand plan. It was never about getting pennies into your account to “help you.” On that same point, the PPP small business loans also achieved obtaining financial data on small businesses and farmers across the country.

This was the biggest engineered transfer of wealth this country has ever seen. 2020 will become crystal clear, once you’ve reviewed this entire report.

“Insights” = Monitoring and Control

When you look into your bank account, do a search for “third parties” and “aggregators.” You may come across an explanation such as this one my bank provided for why they are aggregating your information. They pack it full of fluff and suggest they are doing this for you… “you may want us to deliver useful insights about your finances….allowing you to make smarter financial choices.” Once again, they assure you that you’re not smart enough to manage your own money, just as you need a smart home, smart phone, and smart city to survive.

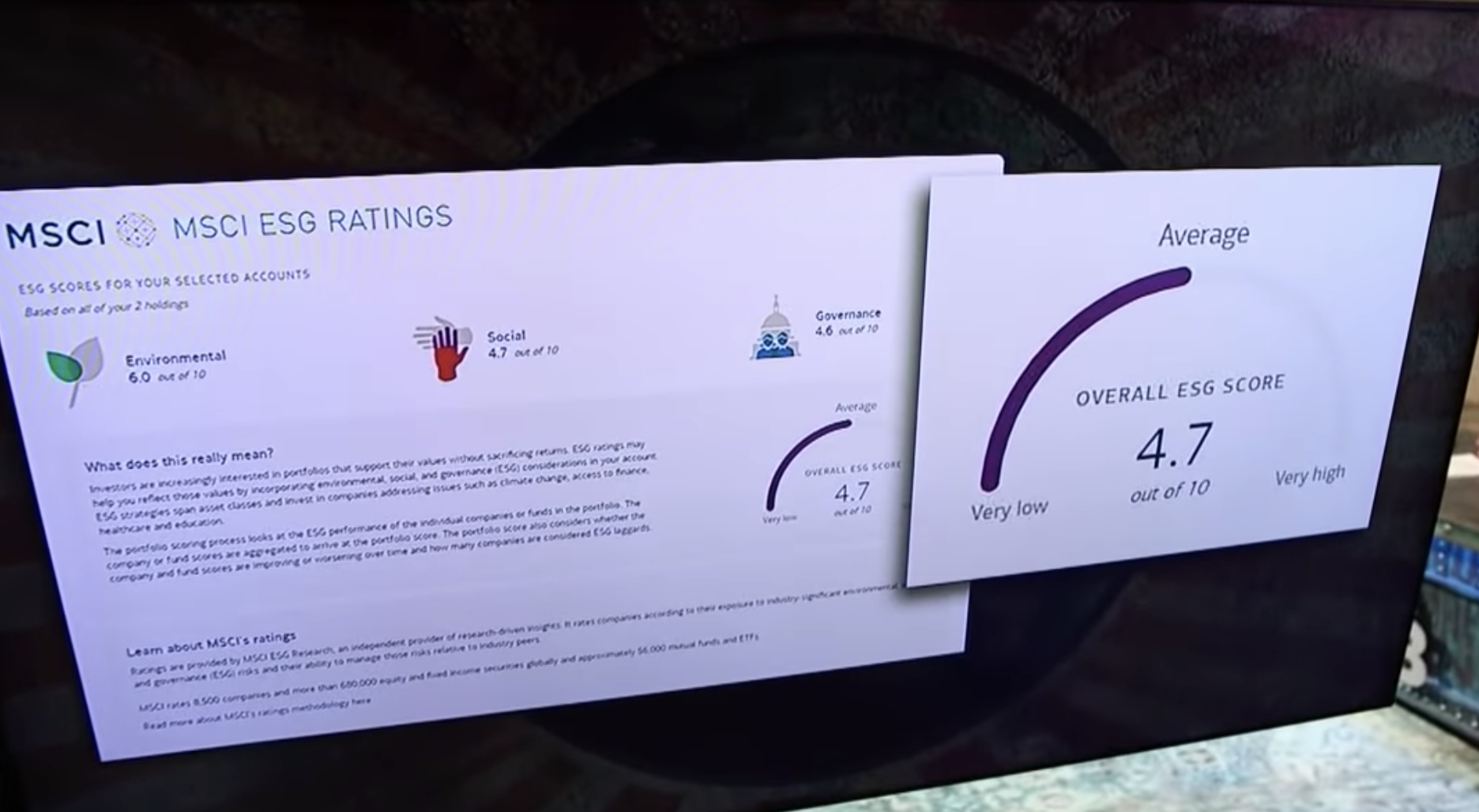

THIS is the framework for the social scoring system. This is how they are doing it, by categorizing your funds in your bank accounts, while also assigning ESG (environmental, social, and corporate governance) scores through other financial institutions pertaining to investments. Those will likely be coming to your bank accounts as well, especially with Biden’s new executive order.

Whereas, they do not list the “income” category in the dropdown (at least in my bank), they assign “income” to various deposits, even if they are not truly income, which can be seen under the individual deposits. Eventually, they will create an “ESG” column for climate-related tracking as well.

The Timeline Reflects Key Actions by BlackRock, Envestnet/Yodlee, Biden, Federal Reserve, US Treasury, Banking Institutions, and The IRS

This timeline will not only show you just how these aggregators are scraping your data, sharing it, and creating the framework for a social and climate score system, it shows who is behind it, how they are running this show, and where this game is headed.

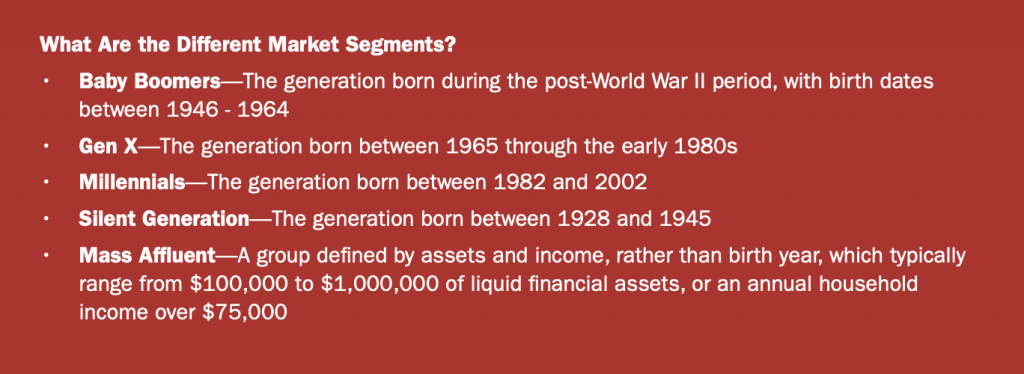

This is how Envestnet, and likely all financial institutions, are targeting people to “embrace the digital revolution.” They see Millennials as being “weaned on technology and social media, and they want nothing less when it comes to their financial lives.”

Envestnet was Founded

Judson Bergman and Bill Crager founded Envestnet in Chicago, IL, and now have branches all across the country. They have numerous trademarks, all registered by Faegre Drinker Biddle & Reath LLP, just a half mile down the road from their office. Envestnet went on to acquire a slew of companies over the years, including FolioDynamix, FDX Advisors, PIEtech MoneyGuide, Yodlee, and more.

Yodlee was Founded

That same year, Yodlee was founded by Sukhinder Singh Cassidy (from Amazon and Junglee), P. Venkat Rangan (vice chancellor of Amrita University), Sam Inala, Srihari Sampath Kumar, and Ramakrishna ‘Schwark’ Satyavolu (all formerly at Microsoft), headquartered in Redwood Shores, CA.

SEC Transcript on Aggregators

Transcript from the United States Securities and Exchange Commission Portals Roundtable on relationships between broker-dealers, internet websites, and aggregator portals. This was during the beginning stages of aggregators scraping data and allowing customers to utilize their aggregator to link to their bank account to see their financial data. They discussed how it all worked, how great the technology could be, and how Yodlee was really the only game in town.

WEF Report on “Beyond Fintech”

World Economic Forum’s fourth report on ‘Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services,’ which is “part of the future of financial services series” prepared in collaboration with Deloitte. It is an eye-opening read and also mentions Yodlee once and BlackRock a dozen times, as well as one of the members being from BlackRock. In fact, when doing a search for BlackRock on WEF’s site, it pulls 588 search results.

Page 9 has an interesting chart, showing “Financial Regionalization” with China, Europe and the U.S. connecting to “delivering AI paths” and “open data.”

Larry Fink, CEO of BlackRock Met with Pope Francis

Pope Francis met with big oil investors to discuss “climate change” at the Vatican. Larry Fink, the CEO of BlackRock, Ernest Moniz, former U.S. Energy Secretary under then-President Obama, and the CEO of BP, ExxonMobil, Equinor, and others were in attendance.

BlackRock Bought Equity Stake in Envestnet & Partnered

BlackRock bought a 4.9% equity stake in Envestnet, and partnered with them to integrate their technology with Envestnet’s “Financial Wellness Network.” BlackRock’s massive technology platform already oversees $21.6 trillion in assets through Aladdin, which is used by the largest fund managers, all of big tech, and beyond. Their goal is to aggressively grow Aladdin to manage risk for the entire asset management industry by 2025.

They have integrated Envestnet platforms with BlackRock Digital Wealth technology, such as iRetire, FutureAdvisor, and Advisor Center, to start with. They want to create a seamless flow of data between BlackRock, Envestnet and custodial platforms. But they’re not the only ones. Charles Schwab & Co. and Fidelity Investments intend to share data with Envestnet/Yodlee, and others. Fidelity owns eMoney Advisor, which is also partnering with Schwab, Yodlee and Intuit. By setting up APIs (application programming interfaces), they all feel that the days of aggregators “hacking data through the password-protected consumer portal” can create a “virtuous circle of data standardization in access and use advances.”

It should come as no surprise that BlackRock, Vanguard, and JP Morgan Chase are the top three shareholders of Envestnet.

Rockefeller Hired Envestnet

Rockefeller Capital Management hired Envestnet to provide research and due diligence services for its newly launched private wealth platform.

> The New Credit Scoring System

The World Economic Forum (WEF) spelled out the new scoring system as “credit worthiness through alternative credit scoring.”

“As AI evolves, the potential to open new paths to economic development is immense. Traditionally, consumers looking for a loan are evaluated on their previous credit history, captured by companies such as Equifax, Experian, TransUnion and others. With AI algorithms, the capability to predict credit worthiness through alternative credit scoring can potentially expand the marketplace to cover over 45 million people in the US alone who have no credit score. Globally, the unmet financing needs of small businesses with no credit data is estimated at $5.2 trillion.”

“Going Direct”

BlackRock’s white paper on “Going Direct” reveals that the central bank is moving funds directly into the hands of public and private sector spenders (meaning equity investors), in a laundering scheme, and this plan is currently being implemented now. John Titus breaks it all down on The Solari Report.

Larry Fink and WEF

Larry Fink, CEO of BlackRock, was appointed as a board of trustee to the World Economic Forum.

CEO of Envestnet Killed in Fatal Car Crash

Less than one year after BlackRock bought an equity stake in Envestnet, and just three months before Covid-19 struck the U.S., Envestnet’s CEO Judson Bergman, and wife Mary Miller, died in a fatal car crash in San Francisco when an allegedly intoxicated woman driving the wrong way on highway 101, struck their taxi around 12:30am, completely totaling both vehicles and killing everyone.

The Bergman’s left behind seven children. Co-founder Bill Crager eventually took over as CEO.

JPMorgan Partnered with Envestnet

JPMorgan Chase announced an agreement with leading data aggregator Envestnet/Yodlee to help “protect customers’ financial data.” They allege that this agreement “will give Chase customers more visibility and control as they use financial apps.”

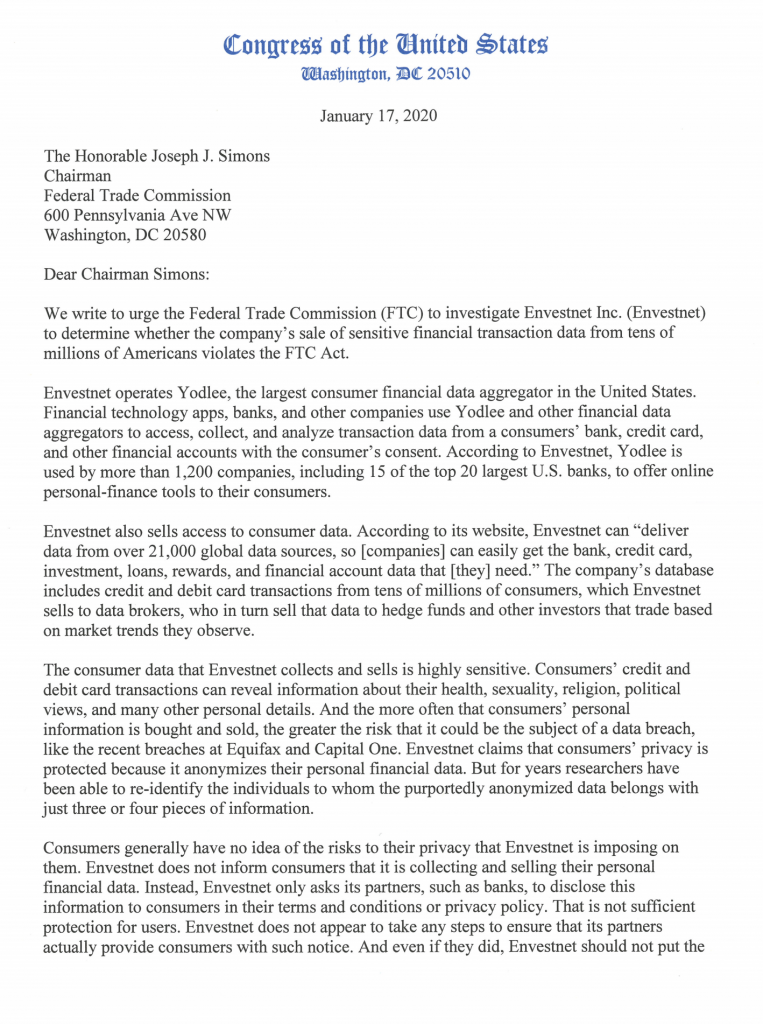

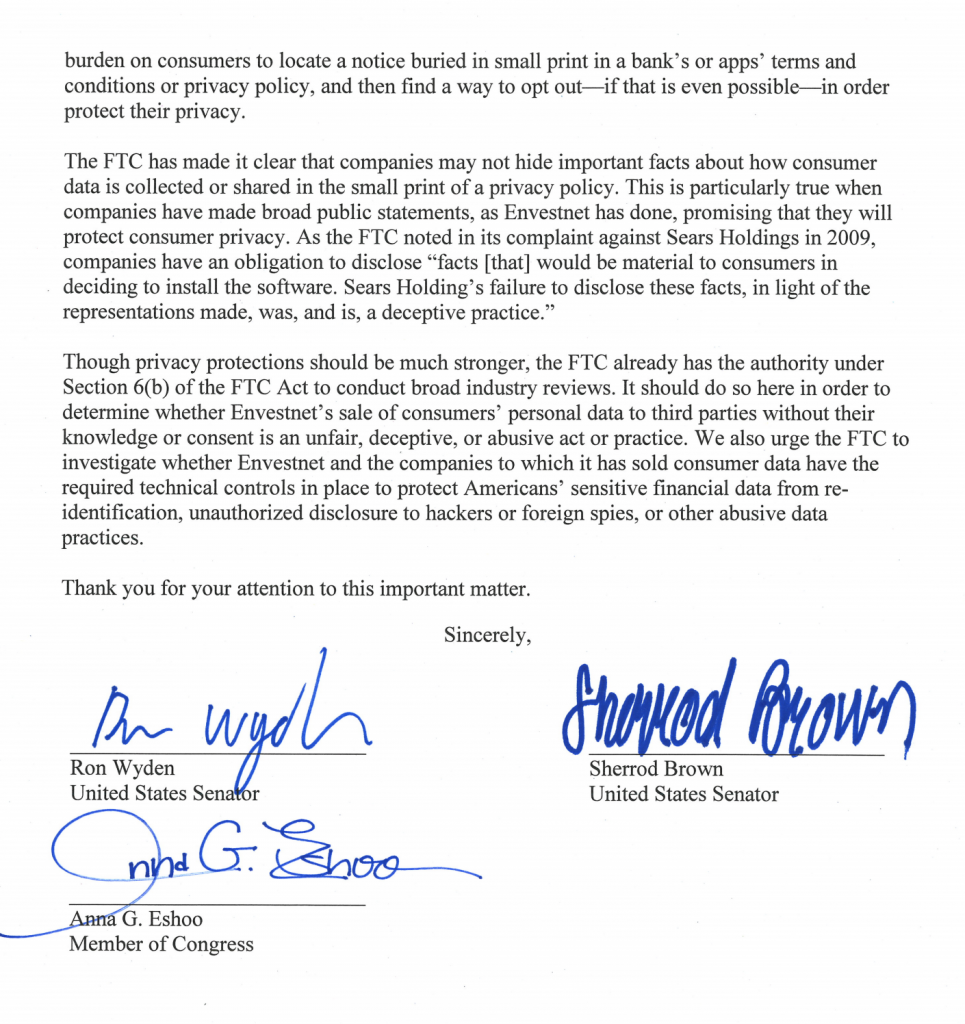

3 Democrats Requested FTC Investigation into Yodlee

Three months after Judson Bergman’s fatal car crash, three democrats, Sen. Ron Wyden D-Ore, Sen. Sherrod Brown D-Ohio, and Rep. Anna Eshoo D-Calif, urged the Federal Trade Commission (FTC) to investigate whether the sale of customer data to third parties violates the FTC Act’s guidance on unfair and deceptive practices.

The timing of all events leading up to this date, and following it, and the fact that this request came from three democrats, is enough to give anyone pause. Intimidation, strong-arming, and setting the stage, all come to mind. They most certainly want this information shared, but only shared through their channels.

When searching the FTC site for an investigation or any documents at all pertaining to Envestnet or Yodlee, nothing could be found.

Reallocation of Capital

BlackRock’s CEO Larry Fink sent a letter to chief executives letting them know that “climate crisis” was going to bring about a “fundamental reshaping of finance,” with a significant reallocation of capital set to take place “sooner than most anticipate.”

Alleged FTC Investigation & Fidelity Launched Data Access Network with 12 Financial Institutions

Envestnet “received a civil investigation demand from the FTC for documents and information relating to our data collection, assembly, evaluation, sharing, correction and deletion practices,” according to an SEC filing that Vice reported on, but no investigative documents or actions are shown on the FTC site against Envestnet.

Meanwhile, FMR LLC, Fidelity Investments’ parent company, launched a data access network firm called Akoya, with backing from 12 financial institutions, including JPMorgan, Wells Fargo, Citi, Bank of America, US Bank, and others, to exchange consumer financial data by integrating the data aggregators, fintechs, and financial institutions.

Federal Reserve Enlisted BlackRock

The U.S. Federal Reserve enlisted BlackRock to direct three of its bond-buying programs.

Not only that, they made the announcement prior to Congress even passing the Cares Act.

ESG Climate Score

The new “mega-trend” of big companies dumping trillions into ESG (sustainable investing) is highlighted in Yahoo finance as the “future of business.” BlackRock intends to have $1.2 trillion in ESG assets within the next 10 years. The strategy aligns with Biden’s “Climate-Related Financial Risk” executive order he signed less than one year later, in May 2021. (see below)

Merrill Lynch began assigning an “ESG Score” to people’s assets back in 2018. This is yet another system to create a social “climate” scoring system in order to control people’s funds. Imagine how this scoring system is going to effect your “credit score?”

Class Action Lawsuit Against Envestnet & Yodlee

A class action lawsuit was filed against Envestnet and Yodlee in the Northern District of California, for Yodlee selling individuals’ data without proper security protections or authorization, and sharing data in unencrypted files.

This is a good breakdown from March of how they case was moving along. The court denied Yodlee’s motion to dismiss the case on several counts, such as “invasion of privacy” and “unjust enrichment,” as well as other claims.

450 Banks Pledged to Align Financing Decisions with Paris Climate Agreement

450 public development banks pledged to align financing decisions with the Paris Agreement on climate change at the first Finance in Common Summit that addressed Covid-19 and the principles of sustainable finance.

Biden Chose BlackRock’s Brian Deese for Director of National Economic Council

President-elect Biden named Brian Deese to be director of the National Economic Council, making him his top economic adviser at the White House. Deese formerly worked with the Obama administration and was instrumental in sealing the deal on the Paris climate accords. After that venture, he was the global head of sustainable investing at BlackRock

.

“Our modern financial system was built on the assumption that the climate was stable. And that assumption has largely dominated existing financial models, and it underpinned the way that we invest capital, the way that we have built society, and the way that we have forecasted for the long term,” said Brian Deese, director of the National Economic Council. “Today, it’s clear that we no longer live in such a world.”

BlackRock’s Michael Pyle Chosen as Chief Economic Adviser to VP Kamala Harris

Biden transition officials announced that

Michael Pyle, former chief investment strategist for BlackRock, would serve as chief economic adviser to Vice President Kamala Harris.

$68 Trillion Transfer of Wealth Plan

Launch of MoneyGuide engine to bring to market one complete ecosystem of APIs for the entirety of the Envestnet network. “This universe of APIs will enable us to power financial wellness for more people and will drive growth for Envestnet,” CEO Bill Crager said.

Envestnet also launched the Envestnet Trust Services Exchange with the integration of Trucendent designed to let advisers facilitate the transfer of wealth from generation to generation without utilizing external attorneys or trust administrators… all $68 TRILLION of it. They have their own network of attorneys and administrators “behind the scenes” that will work with the adviser and client, while the adviser maintains custody of the client’s assets.

SEC Staging Requiring Companies to Disclose Climate Change Risks for Public Compliance

The Securities and Exchange Commission’s Chairwoman Allison Herren Lee announced that they are seeking public input on establishing a regime for requiring companies to disclose the risks they face from climate change. BlackRock and environmental groups have been pushing for mandatory disclosures for a long time. “It’s time to move from the question of ‘if’ to the more difficult question of ‘how’ we obtain disclosure on climate,” Lee said at a virtual event hosted by the Center for American Progress. All of this is to pressure the banks to create a framework of public compliance. This has been planned for a very long time.

Envestnet Acquired Harvest Savings

Envestnet acquired Harvest Savings and Wealth Technologies. “Harvest gives banks the ability to use savings accounts as launch points for people to plan for their future, enabling micro savings, which can connect to investment accounts, again, intelligently connecting people’s financial lives, offering answers and the ability to take action,” Crager said.

They are also in the process of launching cryptocurrency.

“Financial Wellness Ecosystem”

Envestnet breaks down how they intend to spend $30 million for their “financial wellness ecosystem” they announced back in February.

“The [artificial] intelligence of our financial planning infrastructure connects to the portal and threads the consumer’s experience to actionable services to achieve their near and long-term goals,” said CEO Bill Crager.

BIG DAY: Pay Very Close Attention to These Actions Below

The Treasury released a report on the American Families Plan’s tax compliance agenda, with the goal of making sure “Americans pay the taxes they owe” by giving $80 billion to the IRS to increase their resources over the next decade, overhaul outdated technology by deploying machine learning tech that can identify suspect tax filings, and rely on third-party reporting.

“The Government Accountability Office (GAO) and IRS agree that strengthening third-party reporting is one of the most effective ways to improve tax compliance.

The President’s proposal leverages the information that financial institutions already know about the accounts that they house. Financial institutions would add information about total account outflows and inflows to existing reporting on bank accounts.” Their hope is to raise $700 billion in additional tax revenue over the next decade.

Simultaneously on this same day, Biden signed an Executive Order for “Climate-Related Financial Risk,” and Secretary of the Treasury Janet Yellen published a press release stating “Achieving net zero emissions in the United States will require transformational investments in our energy sector and the broader economy, and the global financial sector will be a crucial player, helping channel capital into investments that green our society.”

Under the guise of “protecting families,” “financial wellness,” and “climate financial risk,” they are aligning to have direct access to all of your financial information so they can control it, tell you how to spend it, create a social score for you, and make sure a big chunk goes to the IRS.

Also, on this day, Federal Reserve Chair Jerome H. Powell announced that the Federal Reserve will be publishing a discussion paper this summer, regarding fast-evolving technology for digital payments, with a particular focus on the possibility of issuing a U.S. central bank digital currency.

Another key event took place on this day. Deputy Secretary of the US Treasury, BlackRock’s Wally Adeyemo, was meeting with The Independent Community Bankers of America (ICBA) Board of Directors to discuss the “key role of community banks in providing swift access to essential payments and needed capital for millions of people and businesses throughout the Covid-19 crisis and how Treasury and ICBA can work together to achieve a strong, equitable recovery

moving forward.”

If this isn’t well planned coordination, I don’t know what is.

Jim Yong Kim & WHO

Former World Bank President Jim Yong Kim, who Corey’s Digs has reported on extensively, spoke at the International Finance Forum 2021 Spring Meetings, calling for more funding and independence to the World Health Organization, saying that

financial institutions need to help the

health sector, and that financial institutions shall work more proactively with the World Health Organization, UN agencies, NGOs, and private sectors.

The Engineered Financial Takeover

By the second month of Covid-19 hitting the US, so-called scientists, politicians, and news media were already combining “climate change” with Covid. It was in every headline, on every website, and most of us knew where this was headed. But it’s about far more than all of the climate initiatives. Yes, those are also in place for control and surveillance mechanisms, but using it for the financial takeover was always their main baby. The initiatives will be used to keep everyone in line.

The number one question I am always asked is “what do I do with my finances to protect myself?” I am not a financial advisor, accountant, attorney, or banker, so I can only make suggestions and share the information that I research and connect in the hopes of giving people some advance notice or greater understanding of how this is all shifting and moving.

That said, the majority of people have been well aware of a financial takeover, change in our money system, and using our money to control us, for quite some time, so none of this should come as a shock – it merely fills in some blanks. I’ve been saying for months that people need to pull their money out of the central banks, away from big box stores, and keep your businesses open. My bank wasn’t even a big central bank, but they decided to be in on the action. Search for a smaller, trusted, local bank. Whereas, this may not be the end-all solution, it could certainly provide longevity, while keeping all of our money from the big players. If millions of people did this, it would make a significant dent.

On the same note, if millions of people stood up to the tyranny, challenged their so-called authority, stopped funding the big guys and start funding the little guys, we would see a visible change. THIS is what must happen to slow the pace, and hopefully be able to prevent their planned takeover. They intend on going digital while creeping up cryptocurrency on the sidelines, to eventually force the switch. Separately, I cannot stress enough how important it is to read all “terms and conditions” and “policies and guidelines” on everything you sign, partner with, install, or function under in some way. People must start protecting themselves, thinking outside the box, building outside the system, and challenging the tyranny.

Did you ever notice how banks act a lot like government? We provide them with our hard-earned money, yet they set all of these rules, fees, and regulations, while surveilling us and work toward full control over us. It’s time to dig into your bank and figure out what solutions work best for you and your family, and who you trust with holding your funds. And remember, cash and prepaid credit card purchases equal less tracking. There are good, small, and family-owned local banks out there, you just need to do a little digging.

Under their “climate score” system, residential mortgages, commercial real estate, business lending, project financing, and auto loans will all be affected. In other words, if you have a low “climate credit score,” you are SOL. If you are invested in fossil fuels or the meat industry, count on your score dropping. Now imagine if you want to purchase a new home, and you have a slightly low score, but if you are willing to move into a “smart home” or one of their “smart city micro-units,” you may just be in luck! On the “social score” end of the spectrum, they will likely tie in social media reputations, alleged racism, and potentially unvaccinated, in an attempt to lower your score.

Don’t look at all of this as road blocks. See it for what it is… tyranny. Then, start thinking about how to combat it, work around it, and work together to support one another without having to rely on their corrupt system. The chips don’t have to fall in their favor.

Additional information on the financial takeover:

Finance Fascists: The Credit Chokehold That Will Bankrupt America, BlazeTV. This is an excellent breakdown with invaluable information on how they are implementing social/climate score systems to control your money and lifestyle, and how the Federal Reserve and US Treasury are colluding with the banks to alter our entire financial system, while overstepping government all together.

The Going Direct Reset – The Central Bankers Make Their Move, with John Titus and Catherine Austin Fitts on The Solari Report. You have to be a subscriber to watch this full video, but it is a power-pack of information that they researched and compiled to show exactly how this takeover is going down. Other videos on the Federal Reserve by John Titus.

Download this full report in PDF format in The Bookshop. >>

Please note that the timeline in the PDF is in straight-forward paragraph form.